This article was first published on Livewire.

There’s cautious investing, and then there’s the way that Pete Robinson at Challenger Investment Management does it.

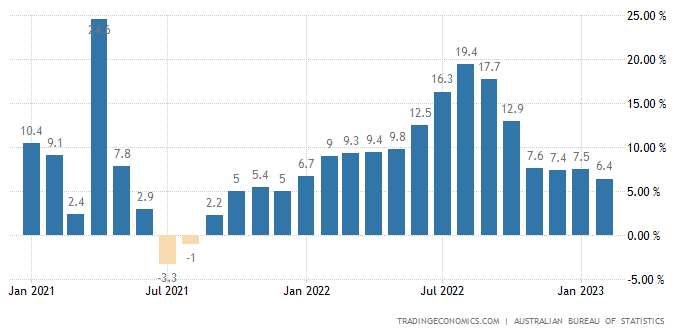

If the world does not go into a recession this year (despite all the forecasts of one), it will likely be because of the resilient consumer. Despite low confidence levels, consumer spending has remained remarkably resilient for a long time. If you need any proof of that, look at Australian retail sales since 2021.

But as is with most things in life, no two consumers are created equal. As Pete Robinson of Challenger Investment Management noted in his recent Expert Insights interview, lower-income consumers are really feeling the pain and the bifurcation between the have’s and have-not’s continues to widen.

“I think there’s a twofold answer to that question is that for some people it is coming to an end and for some it’s not. And that’s a really interesting problem that faces central banks and regulators today.”

Because of all the various possibilities this time around, Robinson also revealed to me that he is preparing for any one of seven recession scenarios. In this wire, I’ll share which scenario he is preparing for and how he is investing on behalf of clients.

EDITED TRANSCRIPT

LW: Is consumer resilience coming to an end in Australia?

Robinson: I think there’s a twofold answer to that question is that for some people it is coming to an end and for some it’s not. And that’s a really interesting problem that faces central banks and regulators today.

So the RBA reported in its latest financial stability review that there’s about 20% of borrowers who are repeatedly drawing down on their offset accounts to presumably pay household and living expenses. So these people are living close to the edge, and increases in interest rates are going to impact them.

But at the same time as that’s occurring, we’ve got six plus percent credit growth in housing credit across owner-occupied and investors. We’ve had a housing market that looks like it’s bottomed, even in the face of 350 basis points of rate hikes. So there’s clearly a substantial cohort of borrowers who are not impacted by these recent rate hikes, who’ve saved up huge amounts during COVID, who have very strong asset backing and are driving inflation and asset prices as we sit here today. So how you adapt to both of those seemingly very separate groups is a really interesting question.

LW: Has all this resilience made the RBA’s job easier or harder?

Robinson: It makes their job a lot harder. And they’ve said this repeatedly, and this isn’t something that’s particularly new, but monetary policy is a pretty blunt tool.

And so the balance there is really: Are you going to look to hike interest rates and potentially put households in the outer suburbs who are living much closer to the edge under pressure? Or are you going to keep rates on hold and benefit inner city dwellers who might be able to buy another investment property? I think those are some of the questions that are facing the central banks right now.

LW: Are you preparing portfolios for a consumer-led recession?

Robinson: When I’m planning portfolio construction, I’m planning six or seven different recessions at any given time. Certainly one of the ones that we are thinking about is a consumer-led recession and how that could impact our portfolios. And I think the important thing when you’re doing portfolio construction, and what I always tell our investors is that you really need to risk manage and think about diversification.

So that’s not being overly exposed to anyone’s sector or industry, not being exposed to any one individual borrower.

Now, it seems a bit trite to say something like that. It’s a bit of a non-answer, but that’s the reality is we don’t know who’s going to be affected and how deeply they’re going to be affected. So diversifying risk, get that idiosyncratic risk away is a really important thing.

Now, when it comes to sort of the consumer itself, when we drill down into that, one of the things that we think is quite interesting is that what we’ve got is a serviceability problem, not an unemployment problem. So unemployment remains below the RBA’s lower bound, and we don’t think it’s going to hit the peaks that it’s hit in previous recessionary periods. And I think that’s a fairly consensus view.

And so what that means is there’s parts of the economy, say unsecured personal lending, the buy-now-pay-later sector which are likely because the overall quantum of debt is lower, and that means the impact of higher interest rates from a dollar perspective, not a relative perspective is lower as well, that those consumers, young people, they may not own their own house, they don’t have large other debts, they’re much more able to service those debts.

We’ve seen those parts of the consumer lending space perform reasonably well and have been okay having a small amount of exposure to those sectors, particularly because I think the markets immediately assume that like in previous cycles, they would underperform.

LW: Is barbelling an appropriate strategy for credit investing right now?

Robinson: I think barbelling is something that should be done with a great amount of caution at all times. We see a lot of barbelling in credit portfolios where there’ll be a small percentage of higher risk exposures and they’ll generate a return that blends across the whole portfolio.

We think that that’s dangerous, because they over-represent from a default perspective and a risk perspective risk allocation in the portfolio. When I talk about diversification, I want to have a really even risk allocation across my portfolio. So blending say, equity-like risks with very low credit risks is a dangerous game in my view.

Access to income and capital stability

Pete’s Fund aims to provide clients with capital stability and income on a regular basis accompanied by lower levels of volatility than traditional fixed income strategies.