So much of financial analysis is comparative. We look for allegories; similar themes and narratives that could inform us about our current situation.

In part due to the significant exposure of US regional banks to commercial real estate, risks in real estate lending markets have been front and centre of investors’ minds. The obvious question is whether the stress in US commercial real estate markets could also emerge in Australia.

And there is stress in the United States. As discussed in our recent quarterly review of markets the office sector is facing nationwide vacancy rates of 20%. In San Francisco, office vacancy rates are 30%, up from 3% in 2019. Average rents are almost 20% below the peak in 2019. In April, the Wall Street Journal reported on an office tower in San Francisco which was valued at US$300 million in 2019 is expected to be sold for US$60 million, an 80% decline in value over 4 years.

Adding to this stress is higher interest rates and wider credit spreads. The drop in operating income and increase in cost of debt is resulting in much weaker debt serviceability. As shown below, a loan written in 2019 will struggle to cover its interest bill if current levels of interest rates and credit spreads are sustained. The maths doesn’t work which is why rating agencies are downgrading deals and defaults are picking up.

US Commercial Real Estate Serviceability (Office)

Here we have used the ICE BofA US Fixed Rate CMBS Index to estimate movements in interest rates and credit spreads. If interest rates increase another 100 basis points or the net operating income on the asset declines another 10% the interest coverage ratio on the loan will drop below 1 times.

To get to a passing ICR for a bank loan (which we define as starting of 1.75x), new equity needs to be contributed to the deal. We estimate up to 50% of the original equity cheque would be required to right-size the bank loan. If the deal slips into the non-bank market where a passing ICR might be more like 1.15 times but the debt cost is significantly higher which reduces the required equity cheque to more like 20% with little in the way of post interest earnings available to equity.

These findings tie into research from Deutsche Bank and Cohen and Steers which showed around one-third of 2023 maturities have a DSCR of less than 1.25 times[1]. Serviceability is very tight.

Before we turn to Australia, it is worthwhile firstly to highlight some key differences with the US:

| Vacancy Rates | In office are much lower in Australia, currently around 13%. Fundamentals are generically better in Australia than the United States; |

| Loan structure | Australian single asset loan market is shorter term and generally floating rate or has short, dated hedging only through to the maturity of the loan. US market is fixed rate and generally longer. Tighter covenants in Australia (LVR, ICR and WALE) but pass through of higher rates is faster here. |

| Lenders | Australian market is not nearly as deep as the US where you have banks, insurers, CMBS and private lenders all actively participating across the risk/return spectrum in the loan. In Australia it is bank loans, corporate bonds issued by REITs and private lenders. |

| Financial Conditions | Impact of withdrawal of funding from regional banks who are around one third of the entire US CRE lending market. US real estate lending is already declining. Financial conditions have not meaningfully tightened in Australia with banks still increasing exposure in aggregate though tightening in office, land and retail exposures. |

| Interest Rates | Base rate moves have been far less significant in Australia as compared to the US. The Fed Funds has increased by 5%, the RBA Cash rate by only 3.75% although the differences in term swap rates is more moderate (around 30bps in the 3 year part of the curve) |

| Credit Spreads | We are yet to see material widening in bank pricing in Australia. CMBS credit spreads around 140 basis points wider than the tights. |

| Maturity Wall | Around 30% of all US commercial real estate loans are due in 2023 and 2024. Australian bank CRE exposures are even shorter with around 35-40% of all loans due in less than 12 months. |

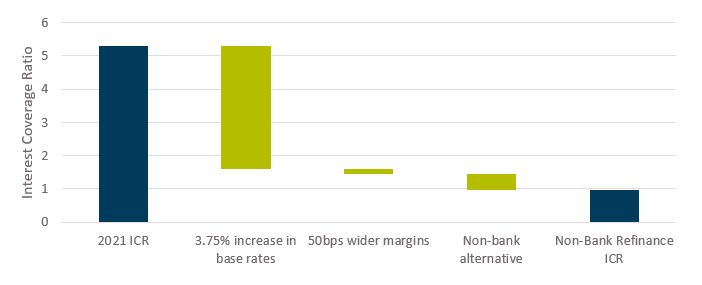

In Australia, we haven’t seen a material reduction in rents, but base rates have increased by more like 3.75% given RBA hikes. The results in the following change in serviceability.

Australia Commercial Real Estate Serviceability (Office)

Again, for Australia, to get to a passing ICR for a bank (which we still define as starting of ICR 1.75x), new equity needs to be contributed to the deal. We estimate up to 20% of the original equity cheque for a bank deal. This is much better than the US in large part due to the fact that credit margins have to date held up in the bank market in Australia and rents have been stable as opposed to declining.

However here if the deal slips into the non-bank market where funding margins are much wider (by >2%), Australia starts to look a lot like the US with significant equity contributions required to pass minimum ICR thresholds.

So, what happens from here?

It’s abundantly clear there are serviceability issues in the United States and Australia. Absent equity contributions we think lenders will respond in the following ways:

- Extend and pretend: if banks accommodate a minimum ICR of 1.5 times, the required equity contribution goes from 20% to 5% of the original equity cheques. In Australia we think many loans will go down this path, with banks recognising that we are likely close to the peak in interest rate but potentially with equity kicking in a small amount to deliver the deal slightly as well;

- Senior/junior structures: for deals where banks aren’t budging on senior leverage, some of the difference between equity and bank debt can be bridged with junior debt. In the case where an additional 20% of equity is required, half could come from a non-bank lender without materially impacting the overall serviceability;

- Non-bank senior with a twist: clearly non-bank lends with minimum ICRs of 1.15 times are unlikely to work at scale and even if they do there is likely a cheaper bank loan available. But lower ICR covenants may be possible if accompanied by structural enhancements such as distribution stoppers or pre-funded interest reserves.

The upshot of all of this is that equity valuations will likely need to come down. We all know this. The vast bulk of the market cannot be sustainably financed on existing capital structures at the current level of interest rates. But domestically we do not see a catalyst that will force a sharp revaluation across the market – as sales start to emerge through 2023 then valuations will start to adjust. This is not the not the case in the United States where the regional banking sector, a significant lender to US commercial real estate, is experiencing a meaningful tightening in financial conditions. The extend and pretend option is far less available as an option as regional banks clearly need to reduce the size of their portfolios. Nor is it available to the CMBS market which needs to be refinanced.

Looking forward, we expect defaults to be heavily weighted towards deals originated during the low interest rates of 2021 and 2022 which will come due in the next couple of years. Not all the defaults will occur in the next couple of years; lenders and borrowers will extend for as long as they can see a path to recovery but the seeds for the losses have already been sown. New deals completed today will reflect the new reality of interest serviceability which at least in part will result in lower loan to value ratios and lower risk and a much improved risk return outcome. The next couple of years could well prove to be the best CRE lending opportunities since the post-GFC period.

On behalf of the team thanks for reading.

Pete Robinson Head of Investment Strategy – Fixed Income

[1] https://www.cohenandsteers.com/insights/the-commercial-real-estate-debt-market-separating-fact-from-fiction/

Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client’s objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report.