What We’re Watching: The impact of higher interest rates on the household borrower

September 2022

Last month we focused on the impact of higher interest rates on the corporate borrower. This month our focus turns to the household.

It’s particularly topical given 1) the RBA again increased interest rates this past week and 2) the quarterly ADI performance statistics were released.

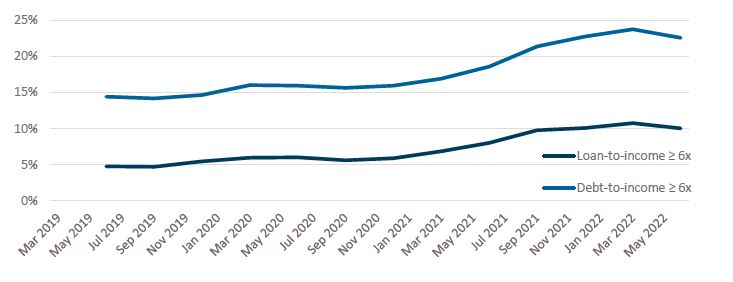

Somewhat surprisingly, the APRA data showed that the share of loans with >6 times loan to income and debt to income ratio remained stubbornly around 10% and above 20%, respectively. We say surprising because one would assume greater risk aversion would see borrowers and lenders alike pursuing lower leverage. However we suspect that these percentages have remained elevated due to the impact of higher interest rates.

ADI High DTI Originations

Source: APRA

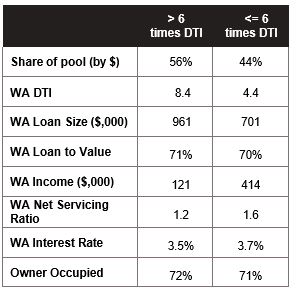

Now while the above mentioned APRA data is interesting, we’d love to know a little more about these borrowers with a >6x DTI ratio. APRA doesn’t provide this detail so we turn to RMBS markets where we can explore loan level data to find out more about this cohort of borrowers and then infer the impact of higher interest rates.

Below we show the stats of a non-conforming RMBS pool from mid 2021. This is the cohort of borrowers with >6x DTI compared to the cohort with <6 times DTI.

The first notable point is that this pool has a significantly higher proportion of borrowers with >=6 times DTI than ADI’s. Whilst we would caution against extrapolating too far, we have investigated other prime and non-conforming pools issued by non-bank lenders and they all tend to run significantly higher shares of borrowers with elevated DTI ratios/lower net servicing ratios. So high DTI lending is more prevalent than what is implied in the APRA data.

We’d also call out that the higher debt to income ratios come with higher loan sizes and lower debt servicing ratios. Interestingly, the income levels of the borrowers appear much lower than lower DTI borrowers. Not low in a societal sense, but certainly lower than the low DTI cohort of borrowers.

Fast forward to today and what we want to do is get a sense of how the >6x DTI borrowers may be faring.

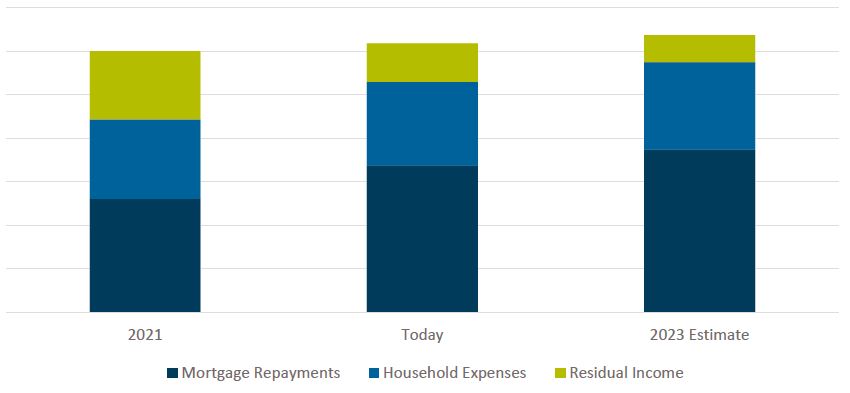

The key variables here are income, housing expenses and non-housing expenses.

- Income year over year is up a little under 3%;

- Non-housing expenses are up c. 5.5%;

- Housing related expenses are up by around 30% based on RBA base rate increases and if interest rate futures markets are to be believed are projected to increase by over 40%

Below we have incorporated the above data to get a sense for how much income these borrowers have after their commitments. The residual income shows the remaining income once mortgage repayments and household expenses have been accounted for.

Residual Income for High DTI Borrowers

Source: CIPAM calculations

Interestingly, even based on the projected level of interest rates, there is still residual income after financial and non-financial expenses. Interest rates would need to increase around 150 basis points over the forward curve to completely wipe out the excess income. Put another way, at 6 times DTI, the average borrower can still pay their mortgage. It is only when DTI gets to around 8.5 times that there is not sufficient income for the average borrower to pay the mortgage and their household expenses.

However, even if we do feel borrowers can still make their mortgage repayments, there are wider implications here. For the >6x DTI borrowers there is around 15% of income that was either being saved or spent on discretionary items that now must be diverted back to the mortgage. Once we factor in the forward curve this is more like 20%. Having peaked at over 20% in early 2020, the savings rate has already declined to 8.7%. This move predates the mortgage rate increases meaning it is almost inevitable that the savings rate declines further from here.

Of course, there is also the reduction in borrowing capacity of around 25% which will weigh on asset prices as well.

To us, these findings have several important investment implications:

- The rise in interest rates is much more about the wider implications of a slowdown in consumer spending than the direct impact on house prices and mortgage repayments;

- Given that most borrowers can continue to service their mortgages, we expect the RBA will be more comfortable hiking rates for longer even as house prices decline;

- Declining savings rates will flow through to funding markets. Banks may start to see deposit flows reverse as household and business reallocate savings to interest repayments and higher expenses.

Pete Robinson Head of Investment Strategy – Fixed Income

Unless otherwise specified, any information contained in this material is current as at date of publication and is provided by Challenger Investment Partners Limited (CIP Asset Management, CIPAM) (ABN 29 092 382 842, AFSL 234678), the investment manager of the CIPAM Credit Income Fund and CIPAM Multi-Sector Private Lending Fund (the Funds). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante) is the responsible entity and issuer of interests in the Funds. Fidante and CIPAM are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com.au should be considered before making a decision about whether to buy or hold units in the Fund. Past performance is not a reliable indicator of future performance.

Fidante and CIPAM are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante and CIPAM. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon.