What We’re Watching: The impact of higher interest rates on the corporate borrower

August 2022

We spent much of 2021 warning about the risks that inflation would prove to be more permanent than transitory. We talked about the risks of payment shocks to mortgage borrowers as interest rates and funding costs increased. We thought markets were significantly under-pricing these risks.

Fast forward to today and we wonder whether the hysteria around inflation is overstated. Sure, interest rates have increased, but what does this actually mean for the economy? Are we facing a wave of defaults brought about by unsustainable interest burdens or is this just a return to more normal conditions and hence potentially less of a concern? And if a concern, where should we be most concerned? What’s the profile of the at-risk borrower?

This month we ask these questions from the perspective of the corporate sector.

A decade ago, the 5 year swap rate was 3.5%, more or less the same level as today. So, what’s the big deal? The big deal is that a year ago the 5 year swap rate was 0.25% and over the previous 5 years it averaged close to 1.5%. For the average ASX300 corporate borrower the reduction in interest rates had a significant impact on profitability and potential leverage.

Consider that, for an average borrower a 2% decrease in their weighted average interest cost would have allowed them to borrow at least a turn of EBITDA more without increasing their interest repayments (i.e., from 2 times to 3 times debt:EBITDA, we are calling this their potential leverage).

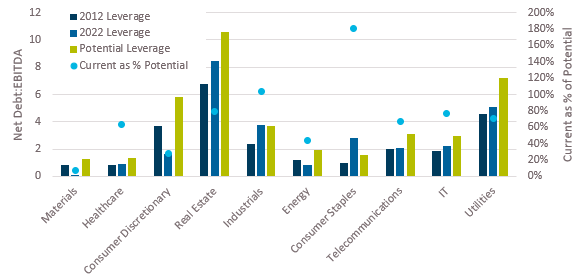

So how much did listed borrowers take advantage of lower interest rates? Generally speaking, they increased leverage over the past decade but not by as much as they could have.

Did Corporate Australia Take Advantage of Low Interest Rates?

The one standout is the consumer staples sector which significantly increased leverage beyond what would be implied simply by the declines in interest rates. Interestingly, this sector traded strongly during COVID-19 outperforming wider equity indices, so the leverage increase was not due to earnings falling off a cliff. However, starting leverage was low making the increase much more manageable from a credit perspective.

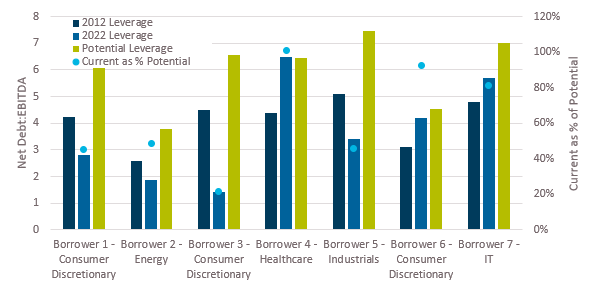

The other sectors with elevated increases in leverage are utilities, industrials and real estate. Concerningly these started much higher leverage than the consumer staples sector. Of course, credit risk in the REIT sector tends to be thought of more in terms of asset coverage than cashflow and utilities tend to be thought of relative to regulated asset bases, but debt servicing is still very relevant. Turning to private lending markets, we substitute individual borrowers for industries to examine the same trends. Here, due to the higher starting leverage and higher impact of credit spreads, the potential to take advantage of lower interest rates is even greater. Indeed, based on 2016-2021 interest rates, a high yield private borrower could have increased their leverage by more than 2 times earnings without increasing their interest burden. But interestingly, borrowers have generally been more cautious with most taking on considerably less than they could have based on interest rates alone.

Did Private Borrowers in Australia Take Advantage of Low Interest Rates?

By only increasing debt to 75% of what they could have borrowed without increasing their interest burden, private debt borrowers will be able to maintain relatively healthy interest coverage ratios of 2.5 or greater. Had they borrowed the full amount, interest coverage would be likely well below 2 times leaving little buffer for any decline in earnings.

In our view Australian corporate borrowers have not been too egregious when it comes to taking on debt in response to lower interest rate.

This being said, certain sectors such as real estate and utilities are worth watching closely. They have increased leverage from a relatively high base. Both sectors are also under revenue pressures with their ability to pass on high interest burdens less clear than historically.

Contrary to what many news articles may be suggesting about private markets, we don’t find much evidence that private corporate borrowers have been running more aggressive capital structures than public borrowers; for the most part we think the opposite.

Next month we’ll explore whether households were more or less aggressive than corporates in taking advantage of lower interest rates.

Pete Robinson Head of Investment Strategy – Fixed Income

1 Consider the combination of the Russian invasion of Ukraine, the decline in the Euro, the fact it is a net importer of energy, the high leverage in sovereign borrowers (eg. Italy) and its close trade ties to China as all contributing to economic pressures.

Unless otherwise specified, any information contained in this material is current as at date of publication and is provided by Challenger Investment Partners Limited (CIP Asset Management, CIPAM) (ABN 29 092 382 842, AFSL 234678), the investment manager of the CIPAM Credit Income Fund and CIPAM Multi-Sector Private Lending Fund (the Funds). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante) is the responsible entity and issuer of interests in the Funds. Fidante and CIPAM are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com.au should be considered before making a decision about whether to buy or hold units in the Fund. Past performance is not a reliable indicator of future performance.

Fidante and CIPAM are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante and CIPAM. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon.