What We’re Watching: Market Review & Outlook – September 2022

October 2022

Non-Financial Credit:

Summary views: public investment grade markets have repriced with pockets of value emerging. European markets look cheapest reflecting the poor macroeconomic conditions, followed by United States then Australia which remains expensive due to lack of issuance. Private markets look attractive and provide diversification in the Australian dollar investment universe though caution is warranted.

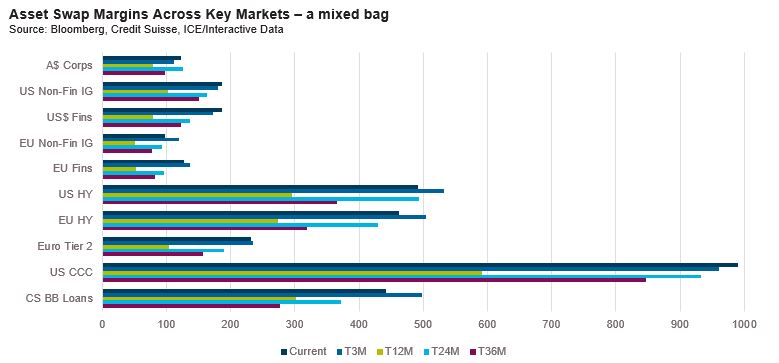

A quick glance at non-financial spreads over the quarter would have sent some conflicting messages. US and Australian investment grade credit was wider, US high yield (loans and bonds but interestingly not CCCs) and European investment grade was tighter. Really the story of Q3 was the inverse of the Q2. Those names which sold off most in Q2 rebounded while the general trend for markets was moving wider.

Here we have simply shown asset swap margins, unadjusted for currency but if you add base rates in you are getting to yields which we haven’t seen for a decade. In Australia investment grade yields are back at 2012 levels while in the United States investment grade yields were last this elevated in mid-2009! Of course, this is much more about the interest rate than spread environment (which is why high yield yields are still below March 2020 levels) but is instructive, nevertheless.

While these yields are attractive, the problem is that in Australia, borrowers are unwilling to meet the market and issue bonds. Non-bank issuance in the third quarter was less than $5 billion, the lowest level of issuance since Q1, 2020 and prior to that the lowest since Q1 2009! The reality is that banks and corporates have plenty of liquidity and banks are cheaper than the bond markets. This is a large part of the reason why corporates trade so tight in Australian dollar markets.

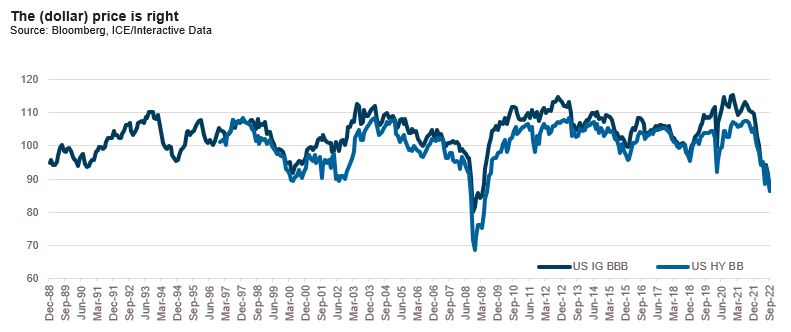

The other factor which we think is worthy of note is that due to the yield movements most of the corporate bond market trades below par. In fact, the dollar price of US BBB rated corporate bonds which is 83 cents on the dollar is the lowest since the GFC and otherwise has never been lower. When dollar prices are so low, even a default can lead to a positive IRR. Consider Verizon 2050 bonds which are trading at 57 cents. If this BBB+ rated issuer defaults, the likely return is positive. Even for high yield bonds, the low dollar price effect is limiting spread widening.

Moving to private markets one of the more topical debates globally has revolved around valuations. Unlike in Australia where most private credit managers do not mark to market1, the global industry standard is to fair value though questions exist around the robustness of those processes. The Cliffwater Direct Lending index provides some indication as to where US Business Development Companies (BDCs) are valuing their private assets. This index showed that weakest first half for senior private loans since 2020 and the second weakest since the index started in 2011. The second quarter return of 0.20% was the second worst performance on record, after Q1 2020.

The increased scrutiny on private lending valuations comes as public and private borrowers face a growing interest burden which is expected to weigh on profitability and ability to service debt. Because private lending markets are mainly floating rate market and typically short dated, it is likely that they will see the impact of higher interest rates much sooner than public market borrowers who borrow at fixed rates. Of course, if these borrowers have swapped their floating rate obligations to fixed, then some of that pressure will be alleviated, at least for a period.

To this end, Standard & Poor’s provided some interesting research on the US middle markets which highlighted sectors with low levels of interest coverage. Six sectors had interest coverage of less than 1.5 times with the lowest being real estate at 1.15 times followed by Road and rail at 1.24 times, Internet software and services at 1.27 times and Wireless telecommunication services at 1.30 times. All of these sectors carry significant levels of leverage (i.e., exceeding 7 times) with Real estate management and development at 12.7 times.

For the real estate sector, a 1% increase in interest rates will take interest coverage to a 1 time multiple. Let’s recall that interest rate futures are pricing in 1.8% in interest rate increases which would take interest coverage to 0.9 times.

This analysis further ignores the fact that credit spreads have widened considerably from the tights of the market. While difficult to observe, we estimate at least another 1-2% of additional interest cost will likely result from wider spreads. Our view remains that investors need to be patient to observe the impacts of higher interest rates and wider credit spreads. In the interim, invest conservatively.

Financial Credit:

Summary views: financials look neutral versus corporates. Offshore has repriced more than domestic financials but that does reflect weaker fundamentals, especially out of Europe. Avoid retail additional Tier 1 market which is significantly overpriced.

For the second quarter running, the financials sector commentary feels like the least interesting across our around the grounds report. At least in domestic markets where the banks are well funded, have no immediate asset quality issues and have strong capital positions.

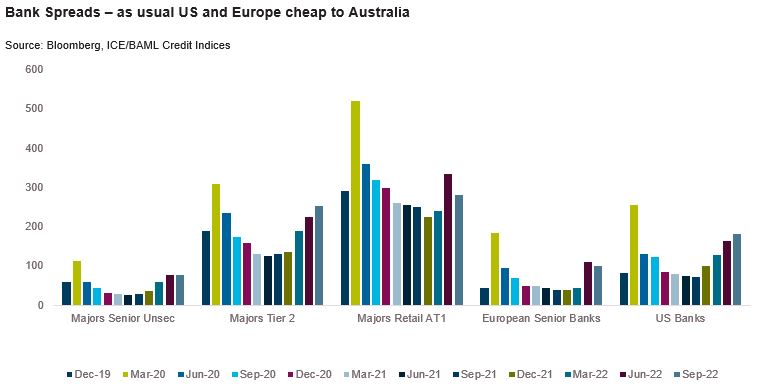

With this in mind charts such as the below one which shows that financial credit spreads have not widened in Australia as much as Europe or the United States are not surprising.

In terms of spread moves, what continues to surprise us is the strong performance of the retail additional Tier 1 market. After widening in June, spreads rallied strongly over the quarter to end well inside of 300 basis points, less than 30 basis points wider than major bank Tier 2 bonds (which themselves widened along with most of the market). At less than 30 basis points, the pickup for going from retail AT1 into Tier 2 is the lowest on record having averaged over 100 basis points prior to COVID.

In our view there is little justification for the trading levels in the retail AT1 market aside from the fact the listed AT1 market benefits overwhelmingly from a buyer base with a limited investment universe. They don’t compare to Tier 2, they don’t compare to securitised credit, they don’t compare to private credit, and they don’t compare to offshore banks.

From a funding perspective, banks are boringly fine. Defying us and others, the major banks continue to pull in deposits which has allowed them to continue to lend. We have observed a slight decline in corporate deposits but would note that they are still $170 billion above pre-COVID levels. Household deposits are at $219 billion and still growing. Until we see deposit flows reverse, we have no concerns about the ability of the banks to repay the Term Funding Facility, regardless of market conditions.

While there is no material private lending market for bank and financial issuers, we’d highlight that banks are the main competitors. And while we are absolutely advocates for the private lending market and believe that tightening credit availability will result in greater opportunities in the years to come, the COVID pandemic has left banks in a stronger funding and capital position than they were prior.

Offshore the picture is decidedly more unclear. The main focus of the market over the third quarter was Credit Suisse which experienced significant volatility as a result of rumours around solvency which spread like wildfire through the Twittersphere. Having ended the June quarter at 200 basis points, Credit Suisse 5 year CDS hit 380 basis points in early October before rallying over 100 basis points. In contrast to the majors in Australia which trade at well over 1 times book value, Credit Suisse and many of their European peers, trade at less than 0.5 times book. The European banking system is plagued by poor profitability, a deteriorating macro environment and overleveraged balance sheets.

In Australia our banks are profitable, thus building capital organically. The higher interest rate environment is adding further rates leverage to their portfolios which will support profitability even in the face of a tighter credit environment. In the United States, the banking systems seems much closer to Australia than Europe with only Citigroup trading below book value.

ABS & Whole Loans:

Summary views: public markets have repriced and secondary market opportunities have emerged in investment grade and crossover tranches. Primary and private markets are on hold until the secondary indigestion is dealt with but there is a large pipeline and it will come to market eventually.

Where to start? This was possibly the most eventful quarter for the domestic securitisation market since the global financial crisis. Let’s recap.

According to the Reserve Bank of Australia the public domestic securitisation market is A$150 billion in size, up around 40% over the past 5 years. Most of the issuance has been AAA rated and placed with a variety of domestic and offshore investors, including:

- Major banks attracted to the repo-eligibility of RMBS and ABS;

- Offshore banks attracted by the outright yield relative to alternatives (think Asian banks with large deposit bases relative to domestic lending);

- Other regulated investors such as pension funds and insurance company attracted by relative returns; and

- Domestic and offshore asset managers who were more focussed on higher returning tranches but would buy opportunistically.

We are fortunate that the major banks are required to disclose their holdings via their Pillar 3 disclosures, so we know that as at 30 June, 2022 they held a combined A$23 billion a figure that has actually declined by 20% over the past five years. We know the other key buyers were offshore banks and other regulated investors such as pension funds and insurance companies.

As for the latter, we know that the largest pension and insurance company buying comes from offshore and includes liability driven investors from the UK. This year, these investors have been selling AAA rated bonds on the secondary market and in September/October they were selling in size. By our estimates in the last month alone they sold around A$2 billion on BWCs (Bids Wanted In Competition; effectively large scale auctions of bond portfolios) in the most relentless period of selling since the GFC.

The selling resulted from liquidity issues in the UK pension fund sector. In short, as UK interest rates increased asset managers on behalf of the funds were forced to raise cash to pay to swap counterparties on their long duration interest rate swaps. They elected to sell floating rate paper like domestic securitisations because it didn’t have interest duration and as such, any selling wouldn’t result in their being underhedged relative to their liabilities. While these funds had severe liquidity pressures, they actually improved their solvency ratios by virtue of their liabilities being discounted at a much higher interest rate.

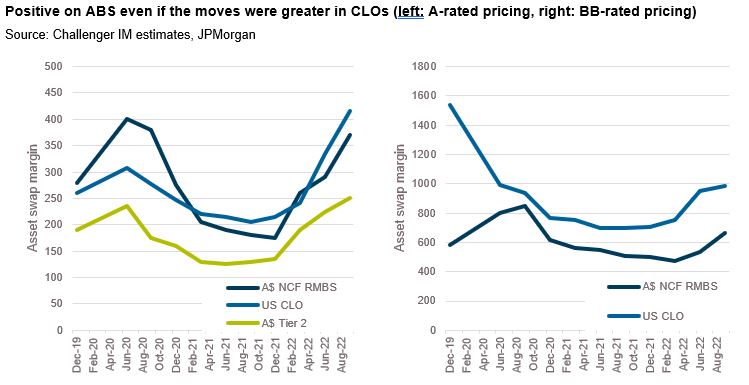

Now these funds weren’t just selling securitised bonds issued out of Australia. They were also selling collateralised loan obligations (CLO’s) and European/UK securitised product. Most of the selling was in AAA rated tranches but as time wore on we saw selling of mezzanine tranches as well, albeit in much smaller size. During the peak of the selling domestic senior AAA rated bonds were clearing in very high 100s in spread terms with junior AAA rated paper trading in the high 200s in spread terms.

On a positive note, the bulk of the selling was cleared albeit we have little visibility on where it ended up. The levels mentioned above represented very good execution for the seller though we’d caution that these are levels for seasoned bonds that had de-levered considerably; whether a new issue can be printed at these levels is anyone’s guess. Right now, there is so much indigestion in the market it is difficult to price a new issue so price discovery is challenged.

As for mezzanine bonds, relative value now looks far more attractive with A-rated secondary trading at around 400 basis points in spread terms with a wide range due to the extreme volatility and illiquidity at the time.

Prior to the onslaught of UK based selling the primary market was open with several interesting deals coming to market. Despite their headline stock price, Zip Money managed to price a new securitisation of the Australian receivables book comprising a split of their ZipPay and ZipMoney products. Athena Home Loans managed to come back to the market and price a deal having pressed pause during the volatility of June.

Despite the technical selling pressure, fundamental performance remains strong domestically. With the unemployment rate still at historical lows, arrears levels remain contained. Levels remain below pre-COVID levels, albeit have ticked up slightly over the past quarter. As we head into a seasonally weaker period for performance, plus await the cumulative impact of higher interest rates, we do expect to see further deterioration in fundamental before.

We’ve long held a negative view on Australian securitised credit and on a relative basis, it may appear logical for us to be even more negatively disposed towards domestic securitised product. The move in the BB-rated part of the capital stack explains our position. CLO pricing is reflecting genuine observable signs of elevated credit risk, particularly at the lower part of the capital stack. Our view is that Australian securitised pricing reflects the potential for weaker fundamentals as well as illiquidity and complexity risks. Perhaps reflecting this, single A paper has tracked CLOs wider whereas BB pricing has lagged.

Real Estate Loans:

Summary views: strong relative value in REITs paper despite governance and valuation risks, domestic private markets activity is picking up.

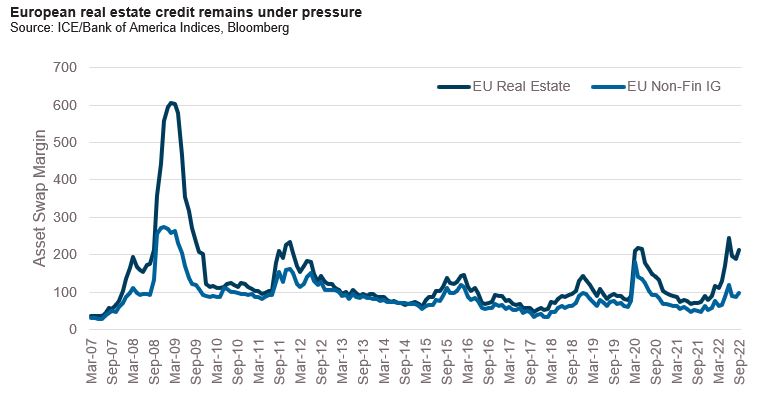

Last quarter we highlighted the significant move wide in European REIT paper. Over the last quarter there was a small rally in both real estate and non-financial credit, leaving the real estate sector continuing to trade wide.

The issues facing the sector are highly topical across the real estate sector globally and more broadly. The impact of higher interest rates is flowing through to valuations with valuation uncertainty exacerbated by governance issues in the sector.

Arguably commercial real estate should perform well in a higher interest rate environment. Yes, the sector does have leverage, but leases are typically inflation linked and higher interest rates should result in higher replacement costs which in turn support valuations of existing assets. However, this nexus is challenged in the near term by several factors:

- Low occupancy for the office sector;

- Capex required to meet green building standards; and

- Lack of transparency around interest coverage and hedging.

For the private market, interest coverage is a major question. The public REIT sector appears to be in a reasonable shape to cope with interest rate increases with interest coverage comfortably above 3 times. In private markets, the impact of higher interest rates is decidedly unclear and hedging will ultimately determine how quickly the loan has to adjust.

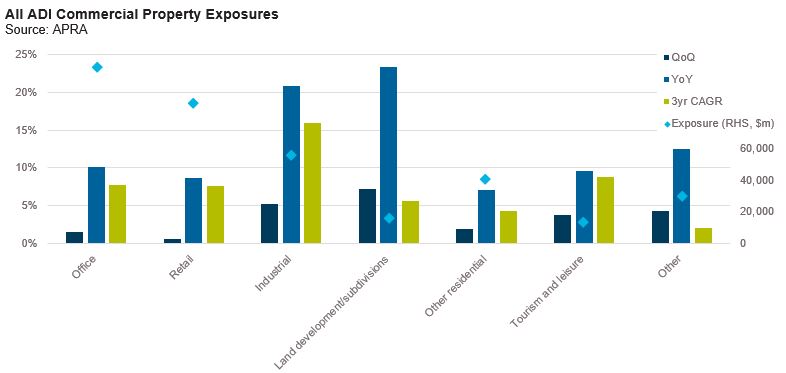

Despite the more challenging lending environment, the banking system continues to extend credit to the commercial real estate sector. APRA data through the June 2022 quarter showed commercial property exposure limits for ADI’s continued to increase ending at $413.8 billion ($357.4 billion drawn) with growth across all sectors, including land development which was up 7% for the quarter.

On behalf of the team thanks for reading.

Pete Robinson Head of Investment Strategy – Fixed Income

1 We fair value our portfolio monthly, benchmarking to observable trading activity in public and private lending markets. More detail is available on request.

Unless otherwise specified, any information contained in this material is current as at date of publication and is provided by Challenger Investment Partners Limited (Challenger Investment Management or Challenger) (ABN 29 092 382 842, AFSL 234678), the investment manager of the Challenger IM Credit Income Fund ARSN 620 882 055 and the Challenger IM Multi-Sector Private Lending Fund ARSN 620 882 019 (the Funds). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante) is the responsible entity and issuer of interests in the Fund. Fidante and Challenger Investment Management are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com.au should be considered before making a decision about whether to buy or hold units in the Fund. Past performance is not a reliable indicator of future performance.

Fidante and Challenger Investment Management are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante and Challenger Investment Management. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.