This article featured in Livewire, 19 November 2021.

Much has been written about how a deterioration in residential mortgage lending standards, questionable structuring and indiscriminate buying of AAA-rated bonds led to the greatest threat to the financial system since the Great Depression. Less has been written about the role played by rising mortgage rates.

In the context of recent moves in interest rates, we decided to take a walk down memory lane to recall how rising mortgage rates played an underappreciated role in the Global Financial Crisis and consider how a rising interest rate environment may impact borrowers in Australia. 1

Cast your minds back to June, 2004. Black Betty by Spiderbait was top of the ARIA charts. Harry Potter and the Prisoner of Azkaban was released at the cinemas. And the US Federal Reserve, piloted by the revered Alan Greenspan, increased the Federal Funds Rate by 25 basis points to 1.25%.

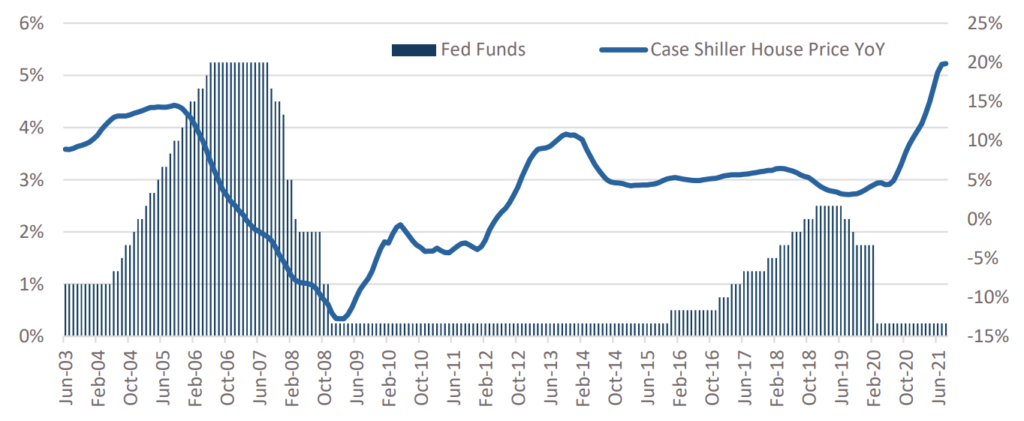

Over the next two years the Federal Reserve repeatedly increased the Fed Funds Rate, finally settling at 5.25% in mid 2006, a cumulative increase of 4.25%. The peak in the Fed Funds coincided with the peak in house prices which proceeded to fall by 27.5% between 2006 and 2011.

The impact of mortgage payment shock was the kerosene that kept the fire burning and contributed to the subprime mortgage crisis becoming a full blown financial crisis spreading far beyond the United States.

A Walk Down Memory Lane – 20 Years of Fed Funds and House Prices

Until house prices started to slow in 2006, mortgage arrears had been contained as borrowers had been able to refinance their loans, even as the Fed Funds rate increased. A key facilitator was short term fixed teaser rates which were set at very low levels for the first couple of years before increasing sharply to a floating rate. The idea for borrowers was that at the end of the teaser period, you would refinance your mortgage to take advantage of a new teaser rate. 2

So long as house prices increased everything was fine. Borrowers took advantage of the low teaser rates and refinanced their home loans every few years, with many taking equity out at the same time.

But as soon as house prices stopped rising, the impact of higher mortgage rates hit like a sledgehammer. Poor underwriting was undoubtedly the spark that set off the Global Financial Crisis but the impact of mortgage payment shock was the kerosene that kept the fire burning and contributed to the subprime mortgage crisis becoming a full blown financial crisis spreading far beyond the United States.

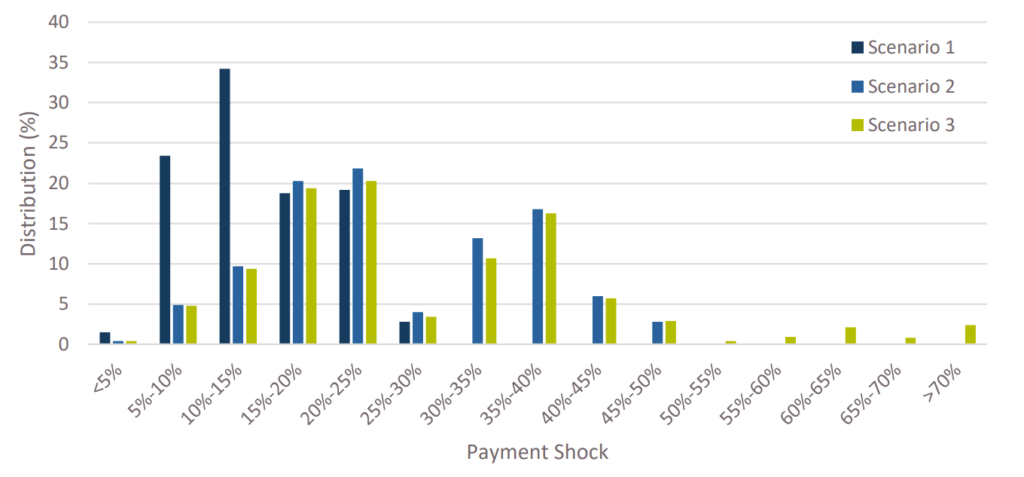

Within the United Kingdom, issues in the mortgage market during the GFC were much more about payment stress and broader macroeconomic weakness than fraud and sloppy underwriting. In 2007 Standard & Poor’s conducted research on the UK mortgage market and found that the impact of declining house prices would see a greater share of borrowers forced to pay stepped up reversionary rates resulting in an increase in monthly repayments of 28% with interest only borrowers facing an increase of 40% as their loans reset to a higher interest rate and principal became payable.

Impact of Payment Shocks in the UK in 2007

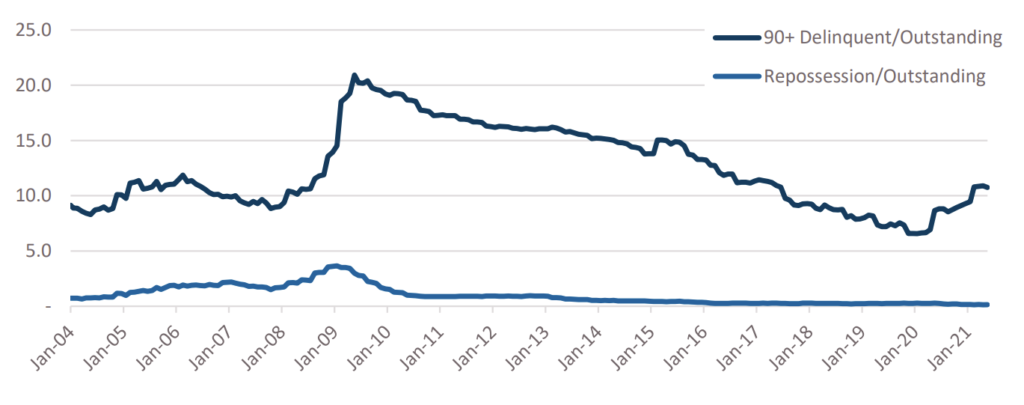

Staying in the UK, cumulative losses on non-conforming RMBS ultimately exceeded 2% with serious arrears exceeding 20% at their peak in 2009.

UK Non-Conforming RMBS arrears doubled during the GFC

Bringing ourselves forward to the current day we see some parallels in Australia.

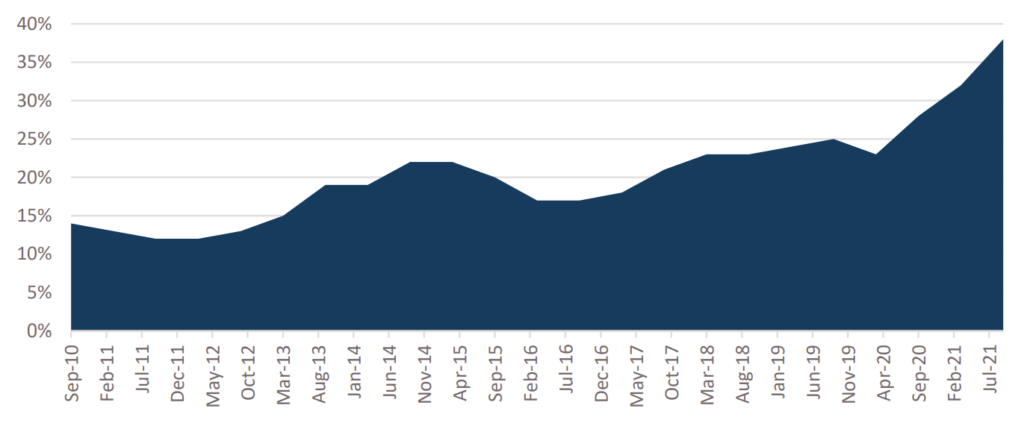

Interest rates are extremely low with fixed rate mortgages pricing well inside of variable rate mortgages, a unique phenomenon in the domestic market. What is important to note is that the very low absolute level of fixed interest rates has led to more Australians fixing their mortgages at any time in recent history.

As several pundits in the media have already noted, the move in repricing fixed rate mortgages is a de facto tightening in financial conditions with far reaching implications for the wider economy.

Westpac: Share of Australian Mortgage Portfolio on a Fixed Rate

This has been a rational response with fixed rates pricing well inside of variable rate mortgages. The sharp increase in fixed rates suggests that most of those fixed rates were originated recently. Indeed, Westpac noted that over 50% of mortgages in the last 6 months were fixed. With fixed rates still well inside standard variable rate mortgages, this shift may not yet be over.3

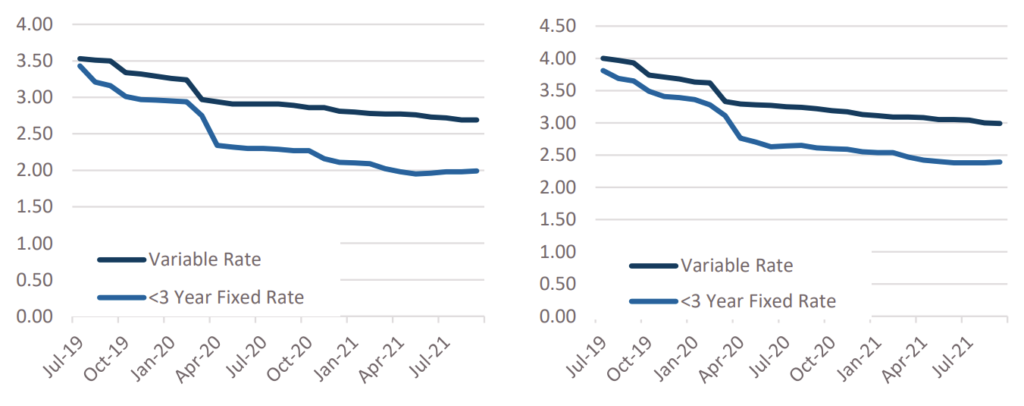

Fixed Interest Rates for Owner Occupied (LHS) and Investment Loans (RHS) are well inside Standard Variable Rates Chart

Priced the way it is, the short term fixed rate mortgage operates the same way as the teaser rate and if interest rates increase, could have a similar impact.4 While banks have constantly reassured us that they always stress borrower’s mortgage repayments for higher interest rates, borrowers have never actually had to pay considerably more on their mortgage.5

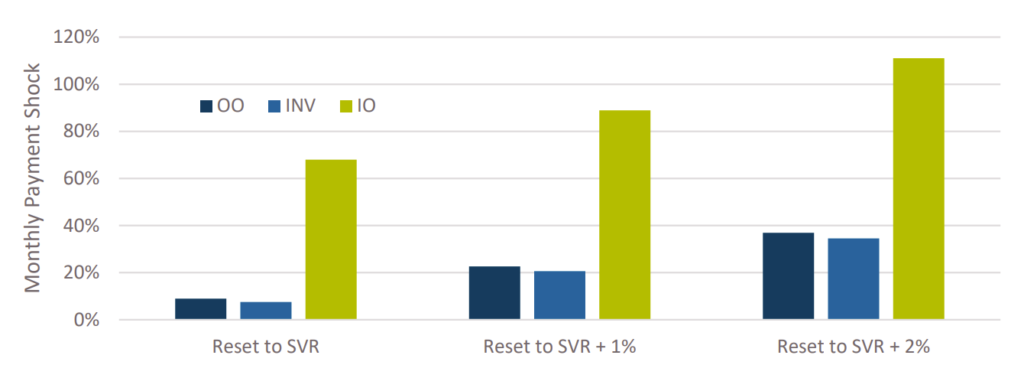

Potential Payment Shock for Fixed Rate Borrowers

With short end interest rates increasing by over one percent in the last few months it would not be unreasonable to see standard variable rates increase by similar amounts over the coming years resulting in payment shocks in the low 20% area for P&I investor or owner occupied mortgages.

For the circa 15% of borrowers on interest only mortgages the payment shock would be more like 90%.

In our view, regardless of whether borrowers can actually repay their mortgages or not, the implications of higher interest rates and a moderate decline in house prices are significant.

As several pundits in the media have already noted, the move in repricing fixed rate mortgages is a de facto tightening in financial conditions with far reaching implications for the wider economy. Investors would be well served to take notice; the hiking cycle has already begun.

1 Before anyone gets carried away, let us be clear we are not suggesting that Australia is about to face its own Global Financial Crisis a la 2007-09. Unlike the United States in the lead up to the GFC, right now in Australia underwriting standards are robust, the financial system is well capitalised, mortgages are full recourse and there strong demographic and technical factors which will place a floor under house prices. This piece is intended to highlight the significance of increasing interest rates on mortgage repayments and consumption.

2 This following brochure provides a good explainer of how an adjustable rate mortgage worked. https://files.consumerfinance.gov/f/201204_CFPB_ARMs-brochure.pdf. If you are interested in the history of the subprime mortgage market the following book is a great summary: Confessions of a Subprime Lender by Richard Bitner.

3 We haven’t discussed the New Zealand market in this piece but would note that it is arguably as exposed as Australia with a much large share of their market fixed, a larger inflation problem and earlier hiking cycle. There fixed rate mortgages have already increased by 0.40% (through September 2021)

4 An important point here is that while the quantum of the interest rate increase is much lower than the reset on a 2007-vintage 2/28 mortgage, the low level of interest rates makes the impact on monthly payments similar.

5 Offset accounts can and do make a difference but the reality is that the fixed rate mortgages were written in the last couple of years and will have far fewer borrowers who are ahead on their monthly payments.