As we noted in part one of our recent primer on private and public credit markets, Public and private — perfecting the blend, the asset class of fixed income has changed dramatically in the past few years.

Refer to part one to understand these aspects of present-day credit:

- Why fixed income is changing and won’t be changing back

- How public and private debt differ

- What the illiquidity premium is — and why it exists

- Why we are seeing a structural decline in the banking sector’s appetite for risk

- Why private equity is moving into the business of lending.

In this conclusion, we examine how co-mingling public and private credit in a single portfolio can be an attractive investment.

THE LIQUIDITY TRADE-OFFS BETWEEN PUBLIC AND PRIVATE DEBT

In contrast to private markets, public debt market liquidity, while still ample in some areas like government bonds and bank debt, has become less abundant in the wake of post-GFC regulations that have made “warehousing” securities more capital intensive for market-making investment banks.

And as we saw during the financial crisis and more recently at the height of the COVID-19 market selloff, even public markets may dry up under extreme conditions—exactly when liquidity is needed most for many investors.

Furthermore, with bank market makers holding fewer securities in inventory and dedicating less capital to trading activities, the ability of the capital markets to accommodate rapidly shifting investor flows is compromised.

This is exacerbated by different characteristics of the investor base for public debt — with a much higher concentration of leveraged investors who use repo or prime brokerage financing for their government bond holdings and most liquid corporate bonds, magnifying liquidity risk when fundamentals shift.

This dynamic doesn’t exist to nearly the same degree in private markets, insulating them from these leverage-driven liquidity events that are becoming more common in public markets.

Moreover, liquidity is becoming more concentrated in the market’s largest public credit issues, which often have large sector concentrations to bank financial credit, a trend that is particularly acute in Australia.

This has already shown to be exacerbated in “risk-off” market environments, as we saw in March 2020. In contrast, private debt markets typically finance smaller companies in less cyclical sectors and have limited exposure to the types of businesses that employ a steady stream of short-term funding, suggesting less exposure to funding risk in private debt markets than in public markets.

Examples include banks and large corporates with access to the commercial paper market or who utilise factoring arrangements such as that facilitated by recently collapsed Greensill Capital.

This all suggests that the liquidity trade-off for private debt investment in the future may not be as high as it has been historically and will also present a considerable opportunity for credit investors with the flexibility to take advantage of dislocated markets. This is particularly apparent as risk premiums in public markets have declined over time.

Time series of risk premiums in public fixed income markets

On the other side of the coin, private debt presents investors with a differentiated opportunity set that may complement their public debt holdings.

Given the complexity of sourcing, structuring and analysing securities in the private markets relative to the public markets, a particularly skilled and sizeable private debt manager may have a notable advantage over the less-adept competition that can’t leverage scale to the benefit of their investors.

This is an inbuilt source of alpha and excess return that is more structural in nature to the private debt asset manager than public markets, where cycles of alpha production can be more variable and less controllable.

Furthermore, since private debt strategies typically deploy investor capital over a multiple-year period rather than all at once, managers are structurally positioned to take advantage of shifting opportunities and valuations as they arise.

And the limited liquidity in private debt suggests that in difficult market environments investors may be less adversely affected by the distressed selling of other investors and can often better control the ultimate outcome of an investment.

THE CASE FOR COMBINING PUBLIC AND PRIVATE DEBT IN ONE PORTFOLIO

Having established that the liquidity divide between public and private debt markets is more nuanced than meets the eye, it stands to reason that perhaps there are good reasons that the two asset classes can coexist in the same portfolio.

Private debt is, for the most part, non-tradable, and asset managers and investors in the space generally view these investments as buy-and-hold.

However, unlike private equity, where a buyer must be found either by listing the asset on public markets, trade sale or selling to another private equity sponsor, in private debt markets the portfolio manager can manage the liquidity profile of the asset pool through the maturity and/or amortisation profile of the debt itself.

This is a very important distinction between the two asset classes, and the critical reason why blending public and private debt in a single portfolio is possible when compared to managing public and private equities.

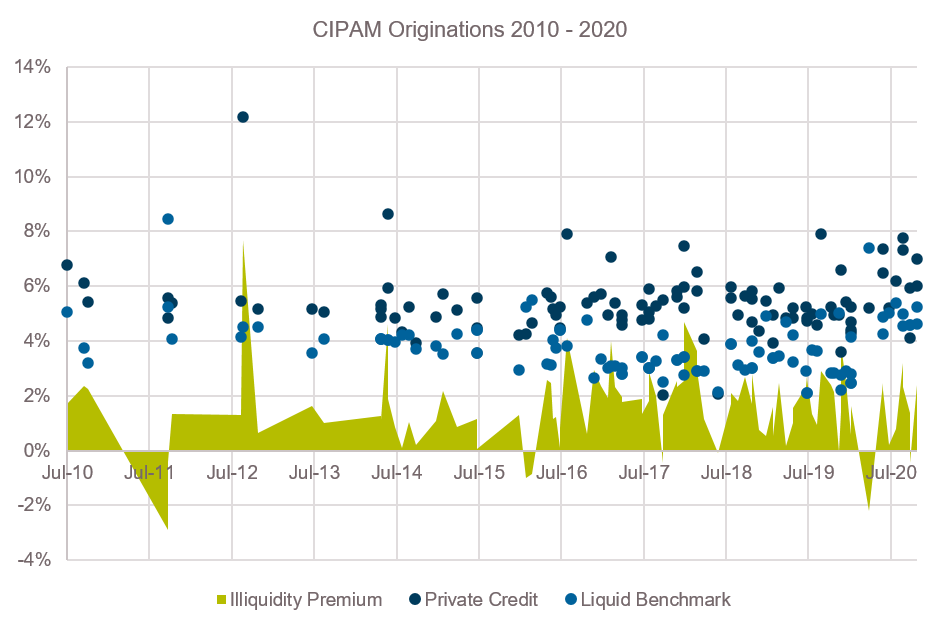

Firstly, the illiquidity premium is also more valuable in a low-rate environment as its contribution to total return becomes more meaningful, as can be seen below.

As returns from this risk premium are driven by very different factors to cash rates, duration and credit risk, it thus adds considerable and meaningful diversification to both a blended public/private credit portfolio as well as to a broader multi-asset portfolio.

ISOLATING THE RETURN DRIVERS IN CREDIT

In addition, the traditional advantages of robust security selection and asset allocation processes on the public-only side are further enhanced by the differentiated opportunity set available in private markets. Compared to distinct public and private portfolios, a one-portfolio solution can offer investors:

- A holistic approach to assessing the credit and liquidity-risk adjusted returns available across fixed income markets and to allocating capital opportunistically and appropriately

- Improved risk efficiency, as public and private investments can be considered in aggregate when managing the portfolio’s industry, sector and credit-quality characteristics, and sector and market cap biases inherent to the public market structure can be diversified through private credit

- A mechanism to take advantage of short-term dislocations in capital markets and their knock-on effects in private markets that wouldn’t otherwise be possible managing separate, fully invested allocations in both asset classes

- A relatively straightforward and efficient way to introduce private debt exposures into an investment program without additional staffing or monitoring costs or having to manage capital calls for closed-end institutional fund structures or additional equity market beta and liquidity risks for investors accessing private debt via listed investment trusts or companies.

A combined public/private portfolio also has an edge in capitalising on stressed financial conditions, as liquidity at the total portfolio level can be deployed across both public and private markets as appropriate to take advantage of market dislocations.

Put another way, it enables investors to average into private debt markets across the cycle in a low-risk way, lowering the timing risk that one might otherwise face putting capital to work in a private-debt only strategy that needs to be fully invested as fast as possible irrespective of the asset class relative value on offer.

From a credit cycle perspective, the best risk-adjusted returns are often found in public credit right after market dislocation events such as COVID-19 as valuation recovery occurs, whereas private debt tends to offer better relative value during the middle and end of the credit cycle as banks ration credit and public market spreads become compressed.

Furthermore, if you take the perspective that illiquidity premium is a real risk premium in the same vein that credit spreads or duration/term structure are as per above, then it can be helpful to analyse how it behaves relative to these other traditional fixed income risk premiums.

The variation in illiquidity premiums reflects the inefficiency of private markets, meaning there is a cyclical and idiosyncratic component. Amidst CIPAM’s historical deals, for example, historical average illiquidity premiums are 2.2% but there is significant variation. Anecdotally, it appears that the level of the risk premium is lower when public credit spreads tighten (i.e. when public markets are performing well) and higher when they widen.

Historical illiquidity premiums in Australian and NZ credit

While it may seem counterintuitive, managers of combined public and private debt strategies can also utilise market liquidity to their advantage. In times of dislocation within the liquid markets, new issue volume can slow due to heightened uncertainty.

During these periods, agile managers can fill the void by providing much-needed liquidity to companies that might otherwise be able to tap public markets, often with enhanced terms. In addition, structures can be more lender-friendly due to the reduced number of financing solutions available.

Thus, actively rebalancing using the amortisation profile of private debt and “locking-in” long term illiquidity risk premiums at optimal times relative to public markets and vice versa can add considerable value across the credit cycle.

Institutional and retail investors need liquidity for any number of reasons. We would argue that asset managers can deliver more attractive liquidity characteristics and capture attractive illiquidity premiums across both public and private debt markets in a combined portfolio than in separate liquid and illiquid mandates that are run in parallel.

By delegating this asset allocation to the manager who is closest to liquidity conditions and relative value opportunities across both sides of the public/private spectrum, you can remove many of the frictions faced by an asset allocator having to manage these liquidity demands themselves and give them a known product-level liquidity profile (e.g. monthly liquidity with a 10% gate per month).

Part of the liquidity enhancement in a one-portfolio solution is simply a function of the structure of some private investments. The short duration and amortising features typical of private securitisation deals create natural liquidity over time, for example, while private corporate or real estate debt issues also may generate pre-maturity liquidity events should the interest rate and spread environment incentivise borrowers to prepay their loans.

Liquidity enhancement also can come from the seamless integration of public and private portfolio management efforts.

For example, short-duration public investments such as asset-backed securities or investment-grade floating-rate securities can be added to maximise portfolio income while also providing funding, over time, for private investments.

Asset allocators running separate allocations or products are less able to do this as they won’t be intimately familiar with the amortisation of the private debt profile and/or may have to hold zero-carry cash to fund capital calls for closed-ended private debt allocations with uncertain timing.

As the opportunity set evolves and expands — particularly in diverse private markets — combined portfolios may be better positioned to capitalise on innovative new structures as well. This could include innovative structured finance arrangements where unique economics can be extracted by virtue of meeting unique needs (for example, regulatory capital relief structures for banks or unique securitisation arrangements for non-bank lenders or other types of corporates).

INVESTOR APPLICATIONS OF COMBINED PUBLIC AND PRIVATE DEBT PORTFOLIOS

A product or mandate offering a combined public/private debt strategy can be suitable for a range of investment objectives. These include:

1. Absolute return or higher targeted alpha strategies

Broad and flexible strategies tend to lend themselves to higher absolute or relative return objectives, as the expansive opportunity set naturally presents more possibilities. In addition, as any solution offering a meaningful private debt allocation is very unlikely to offer daily liquidity unless it is prepared to take significant fund lock-up risk, the greater flexibility public/private mandates have in deploying capital can help make absolute-return objectives more achievable, particularly if interest rates rise and credit spreads widen through avoiding redemption risk at the worst possible time and thus enabling higher conviction investing during times of market stress.

2. Liability-aware strategies or goal-based investment approaches

For investors operating in a liability-hedging framework or managing portfolios designed to fund certain future spending objectives at points in time (goals-based investing), public/private debt portfolios offer a number of advantages. For many of these portfolios, this type of highly opportunistic strategy can help generate additional returns and income as a complement to the liquid, high-quality investments held to match those liabilities or goals. In addition, given that many such portfolios have less need for current liquidity than traditional portfolios, we believe that a public/private combination can be beneficial to target higher income and returns and thus drive higher plan funding levels or probability of meeting the specified goal.

3. As a complement to core fixed income

With an environment of low interest rates, relatively low credit spreads and potentially declining diversification benefits from duration exposure, we believe investors also should consider an opportunistic-type allocation as a complement to their core strategies. Introducing private debt via a combined public/private portfolio can offer investors modest exposure to this market segment — and its potentially higher income and return levels and diversification benefits — without the complexity and with greater liquidity than a separate private debt allocation would demand.

4. As an alternative to traditional credit strategies

Combined public/private portfolios in one strategy potentially can be used as part of a long-term allocation strategy, allowing managers to deploy capital into private debt opportunistically over an extended period of time whilst maximising carry from public markets and benefiting from the market intelligence and a consistent approach to relative value assessment obtained through activities in both markets. With relatively low yields currently available in public markets, this type of unhurried approach may prove attractive to some investors.

CONCLUSIONS

The traditional way of looking at both equity and fixed income asset classes is to divide them strictly along public and private market lines, and to allocate to separate strategies accordingly.

While the nature of private equity favours highly binary and time-dependent liquidity profiles, hindering the ability to dynamically allocate across asset classes holistically from a relative value perspective in the same portfolio, the divide in liquidity between public and private credit is much more blurred.

Furthermore, the liquidity premium itself has characteristics of being its own asset class from a diversification perspective, applying to both public and private debt assets, and time varying in quantum across the cycle.

As demonstrated above, these asset classes have complementary qualities that can be exploited to efficiently manage exposures throughout the cycle, while building a portfolio that provides diversification and yield premium relative to traditional fixed income.

Furthermore, an allocation to both public and private credit within a single portfolio management approach maximises an investor’s ability to take advantage of dislocations across both markets.

This piece was co-authored by Sam Morris, CFA – Senior Investment Specialist, Fidante Partners & Pete Robinson, Head of Investment Strategy and Portfolio Manager, CIP Asset Management.